Introduction To Financial Accounting

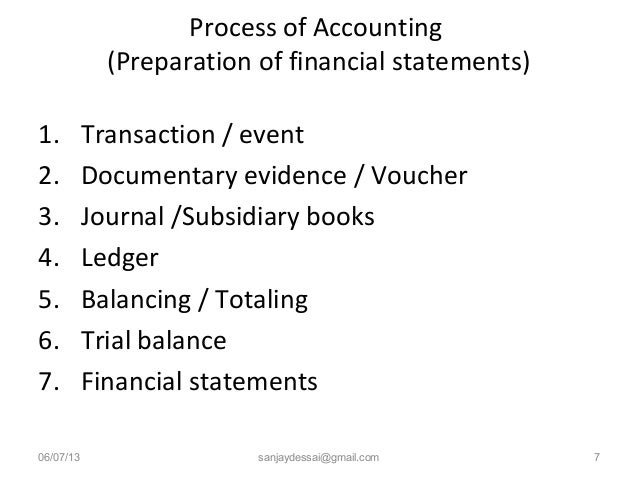

Financial Accounting. Introduction. The purpose of accounting is to provide the information that is needed for sound economic decision making. The main purpose of financial accounting is to prepare financial reports that provide information about a firms performance to external parties. Managerial accounting contrasts with financial accounting in that managerial accounting is. Financial accounting, on the other hand, is performed according to Generally Accepted Accounting Principles GAAP guidelines. The primary accounting professional association in the U. Introduction To Financial Accounting' title='Introduction To Financial Accounting' /> S. American Institute of Certified Public Accountants AICPA. Oh Yes I Am Single Pdf there. The AICPA prepares the Uniform CPA Examination, which must be completed in order to become a certified public accountant. To be eligible to become a CPA, one needs an undergraduate degree in any major with 1. Of these 1. 50 credit hours, a minimum of 3. Only about 1. 0 of those taking the CPA exam pass it the first time. Accounting Terms and Accounting Principles Financial Accounting video introduces the foundational terminology necessary in accounting and business. Accounting Standards. In order that financial statements report financial performance fairly and consistently. These standards are referred to as Generally Accepted Accounting Principles, or simply GAAP. Generally Accepted Accounting Principles are those that have substantial authoritative support. Accrual vs. Cash Method. Many small businesses utilize an accounting system that recognizes revenue and expenses on a cash basis. Most larger businesses, however, use the accrual method. Under the accrual method, revenues and expenses are recorded according to when they are earned and incurred. For example, under the accrual method revenue is recognized when customers are invoiced. Similarly, an expense is recognized when the bill is received, not when payment is made. Under accrual accounting, even though employees may be paid in the next accounting period for work performed near the end of the present accounting period, the expense still is recorded in the current period since the current period is when the expense was incurred. Underlying Assumptions, Principles, and Conventions. Preface xiii Part 1 The framework of financial reporting 1 1 The search for principles 3 Overview 3 Introduction 3 Accounting theory 5 The FASB conceptual. Financial Accounting 1 This chapter covers the following topics Definition of Accounting Objectives Scope Accounting Process. Learn about the role accounting plays in an organization and how to prepare and analyze financial statements. Financial Accounting and Reporting FOURTEENTH EDITION Barry Elliott and Jamie Elliott. Financial accounting relies on the following underlying concepts Assumptions Separate entity assumption, going concern assumption, stable monetary unit assumption, fixed time period assumption. Principles Historical cost principle, matching principle, revenue recognition principle, full disclosure principle. Modifying conventions Materiality, cost benefit, conservatism convention, industry practices convention. Financial Statements. Businesses have two primary objectives. Solvency represents the ability of the business to pay its bills and service its debt. The four financial statements are reports that allow interested parties to evaluate the profitability and solvency of a business. These reports include the following financial statements. Income Statement. Statement of Owners Equity. Statement of Cash Flows. These four financial statements are the final product of the accountants analysis of the transactions of a business. A large amount of effort goes into the preparation of the financial statements. The process begins with bookkeeping, which is just one step in the accounting process. Bookkeeping is the actual recording of the companys transactions, without any analysis of the information. Accountants evaluate and analyze the information, making sense out of the numbers. For the reports to be useful, they must be Understandable. Fair and Objective free from bias. Double Entry Accounting. Financial accounting is based on double entry bookkeeping procedures in which each transaction is recorded in opposite columns of the accounts affected by the exchange. Double entry accounting is a significant improvement over simple and more error prone single entry bookkeeping systems. Fundamental Accounting Model. The balance sheet is based on the following fundamental accounting equation. Assets Liabilities Equity. This model has been used since the 1. It essentially states that a business owes all of its assets to either creditors or owners. To record transactions, one must. Identify an event that affects the entity financially. Measure the event in monetary terms. Sql Concatenate Rows Microsoft Access'>Sql Concatenate Rows Microsoft Access. Determine which accounts the transaction affects. Determine whether the transaction increases or decreases the balances in those accounts. Record the transaction in the ledgers. Most larger business accounting systems utilize the double entry method. Under double entry, instead of recording a transaction in only a single account, the transaction is recorded in two accounts. The Accounting Process. Once a business transaction occurs, a sequence of activities begins to identify and analyze the transaction, make the journal entries, etc. Because this process repeats over transactions and accounting periods, it is referred to as the accounting cycle. Recommended Reading. What is SAP FI Introduction of SAP Financial Accounting. SAP FI Financial Accounting module and its importance in SAP systems will be discussed in this article. In SAP FICO, SAP FI stands for Financial Accounting and CO stand for Controlling. SAP FI is a backbone of SAP that helps to records, collects and process various financial transactional information on real time time. With SAP Financial Accounting you can extract the necessary data for external reporting. SAP FI module can be tightly integrated with other SAP Modules like SAP Controlling CO, Material Management MM, Sales and Distribution SD, Human Resources HR, Production Planning and with various ERP modules. SAP FI Module Components. The SAP Financial Accounting Application consists the following sub components. General Ledger FI GL The statements of Balance Sheet and Profit Loss accounting are extracted based on the general ledger accounting. The data that has been entered in SAP system is posted immediately to the GL and SAP CO system. Accounts Payable SAP Accounts Payable sub module manages all the activities of Vendor transactions. FI AP module links with SAP MM Module, Asset Accounting AA, Travel Management, etc. In Accounting module you can create payment program for processing payments to vendors from time to time. Accounts Receivable SAP Accounts Receivable FI AR sub module manages all the activities of customers transactions. FI AR module links with SAP SD module. Stinger For Radio Broadcasting'>Stinger For Radio Broadcasting. In Accounts Receivable you can create Dunning Program for managements of credit functionalities. Bank Accounting SAP Bank Accounting FI BA sub module manages the bank transactions and cash management. It can be integrated with Accounts Payable, Accounts Receivable, travel management, MM, SD, etc. Asset Accounting SAP Asset Accounting FI AA sub modules manages all the actives of organisational assets like depreciation, Insurance, etc. FI AA module can be integrated with other modules and sub modules of SAP like General Ledger, Accounts Receivable, Controlling, MM module, PP module, etc. So asset accounting manages financial activities from procurement of assets to its final scrapping or sales. Travel Management SAP Travel Management FI TM sub module manages all actives of business trips of organization. It can be integrated with Accounts Payable, SAP HCM, SAP controlling, etc. In FI TM you can manages travel request, travel planning and travel expenses. Continue to read our free SAP FICO training tutorials with real time scenarios.

S. American Institute of Certified Public Accountants AICPA. Oh Yes I Am Single Pdf there. The AICPA prepares the Uniform CPA Examination, which must be completed in order to become a certified public accountant. To be eligible to become a CPA, one needs an undergraduate degree in any major with 1. Of these 1. 50 credit hours, a minimum of 3. Only about 1. 0 of those taking the CPA exam pass it the first time. Accounting Terms and Accounting Principles Financial Accounting video introduces the foundational terminology necessary in accounting and business. Accounting Standards. In order that financial statements report financial performance fairly and consistently. These standards are referred to as Generally Accepted Accounting Principles, or simply GAAP. Generally Accepted Accounting Principles are those that have substantial authoritative support. Accrual vs. Cash Method. Many small businesses utilize an accounting system that recognizes revenue and expenses on a cash basis. Most larger businesses, however, use the accrual method. Under the accrual method, revenues and expenses are recorded according to when they are earned and incurred. For example, under the accrual method revenue is recognized when customers are invoiced. Similarly, an expense is recognized when the bill is received, not when payment is made. Under accrual accounting, even though employees may be paid in the next accounting period for work performed near the end of the present accounting period, the expense still is recorded in the current period since the current period is when the expense was incurred. Underlying Assumptions, Principles, and Conventions. Preface xiii Part 1 The framework of financial reporting 1 1 The search for principles 3 Overview 3 Introduction 3 Accounting theory 5 The FASB conceptual. Financial Accounting 1 This chapter covers the following topics Definition of Accounting Objectives Scope Accounting Process. Learn about the role accounting plays in an organization and how to prepare and analyze financial statements. Financial Accounting and Reporting FOURTEENTH EDITION Barry Elliott and Jamie Elliott. Financial accounting relies on the following underlying concepts Assumptions Separate entity assumption, going concern assumption, stable monetary unit assumption, fixed time period assumption. Principles Historical cost principle, matching principle, revenue recognition principle, full disclosure principle. Modifying conventions Materiality, cost benefit, conservatism convention, industry practices convention. Financial Statements. Businesses have two primary objectives. Solvency represents the ability of the business to pay its bills and service its debt. The four financial statements are reports that allow interested parties to evaluate the profitability and solvency of a business. These reports include the following financial statements. Income Statement. Statement of Owners Equity. Statement of Cash Flows. These four financial statements are the final product of the accountants analysis of the transactions of a business. A large amount of effort goes into the preparation of the financial statements. The process begins with bookkeeping, which is just one step in the accounting process. Bookkeeping is the actual recording of the companys transactions, without any analysis of the information. Accountants evaluate and analyze the information, making sense out of the numbers. For the reports to be useful, they must be Understandable. Fair and Objective free from bias. Double Entry Accounting. Financial accounting is based on double entry bookkeeping procedures in which each transaction is recorded in opposite columns of the accounts affected by the exchange. Double entry accounting is a significant improvement over simple and more error prone single entry bookkeeping systems. Fundamental Accounting Model. The balance sheet is based on the following fundamental accounting equation. Assets Liabilities Equity. This model has been used since the 1. It essentially states that a business owes all of its assets to either creditors or owners. To record transactions, one must. Identify an event that affects the entity financially. Measure the event in monetary terms. Sql Concatenate Rows Microsoft Access'>Sql Concatenate Rows Microsoft Access. Determine which accounts the transaction affects. Determine whether the transaction increases or decreases the balances in those accounts. Record the transaction in the ledgers. Most larger business accounting systems utilize the double entry method. Under double entry, instead of recording a transaction in only a single account, the transaction is recorded in two accounts. The Accounting Process. Once a business transaction occurs, a sequence of activities begins to identify and analyze the transaction, make the journal entries, etc. Because this process repeats over transactions and accounting periods, it is referred to as the accounting cycle. Recommended Reading. What is SAP FI Introduction of SAP Financial Accounting. SAP FI Financial Accounting module and its importance in SAP systems will be discussed in this article. In SAP FICO, SAP FI stands for Financial Accounting and CO stand for Controlling. SAP FI is a backbone of SAP that helps to records, collects and process various financial transactional information on real time time. With SAP Financial Accounting you can extract the necessary data for external reporting. SAP FI module can be tightly integrated with other SAP Modules like SAP Controlling CO, Material Management MM, Sales and Distribution SD, Human Resources HR, Production Planning and with various ERP modules. SAP FI Module Components. The SAP Financial Accounting Application consists the following sub components. General Ledger FI GL The statements of Balance Sheet and Profit Loss accounting are extracted based on the general ledger accounting. The data that has been entered in SAP system is posted immediately to the GL and SAP CO system. Accounts Payable SAP Accounts Payable sub module manages all the activities of Vendor transactions. FI AP module links with SAP MM Module, Asset Accounting AA, Travel Management, etc. In Accounting module you can create payment program for processing payments to vendors from time to time. Accounts Receivable SAP Accounts Receivable FI AR sub module manages all the activities of customers transactions. FI AR module links with SAP SD module. Stinger For Radio Broadcasting'>Stinger For Radio Broadcasting. In Accounts Receivable you can create Dunning Program for managements of credit functionalities. Bank Accounting SAP Bank Accounting FI BA sub module manages the bank transactions and cash management. It can be integrated with Accounts Payable, Accounts Receivable, travel management, MM, SD, etc. Asset Accounting SAP Asset Accounting FI AA sub modules manages all the actives of organisational assets like depreciation, Insurance, etc. FI AA module can be integrated with other modules and sub modules of SAP like General Ledger, Accounts Receivable, Controlling, MM module, PP module, etc. So asset accounting manages financial activities from procurement of assets to its final scrapping or sales. Travel Management SAP Travel Management FI TM sub module manages all actives of business trips of organization. It can be integrated with Accounts Payable, SAP HCM, SAP controlling, etc. In FI TM you can manages travel request, travel planning and travel expenses. Continue to read our free SAP FICO training tutorials with real time scenarios.